Download This Resource

"*" indicates required fields

Our Policy Administration software is hosted in a secure, private cloud environment. We take a transaction-based approach to product configuration, policy issuance, and policy lifecycle events, including financial and non-financial processing. Leading carriers use the system to support open and closed blocks of individual and group products.

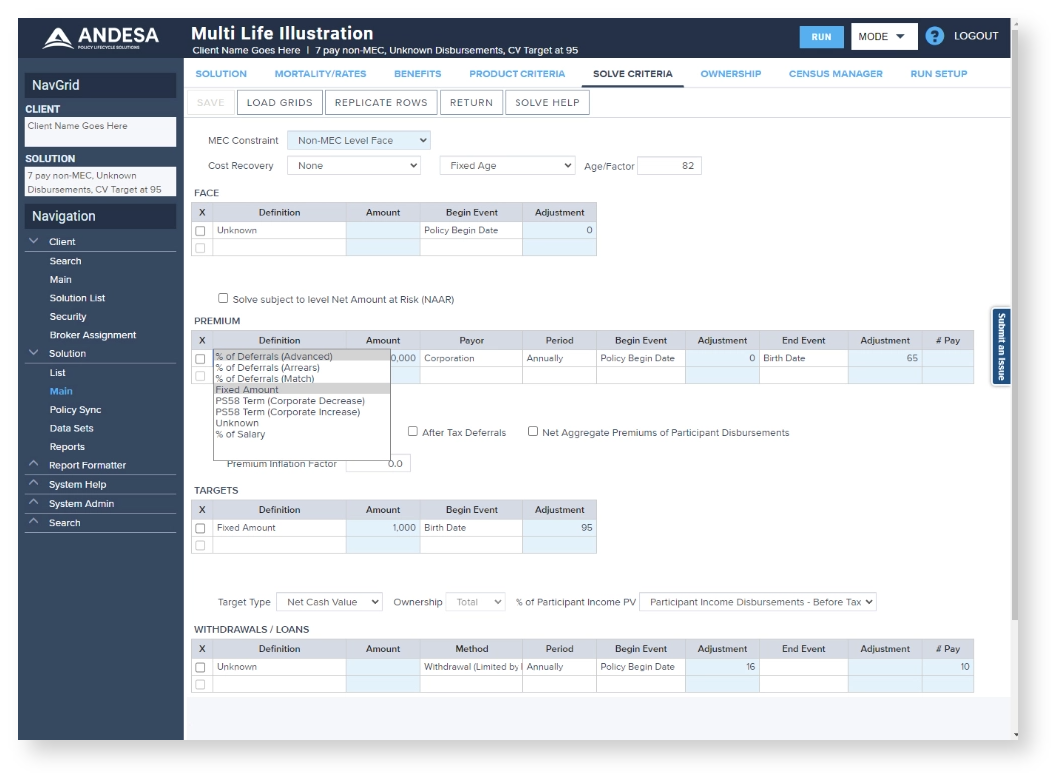

We enable life insurance brokers and carriers to leverage uniquely accurate pre-sale and inforce projection for a wide variety of group and individual life policies in a secure, private cloud environment that can be accessed anytime and anywhere. While its available as a standalone solution, our Illustrations solution offers maximum value when integrated with the Policy Administration and Plan Administration solutions.

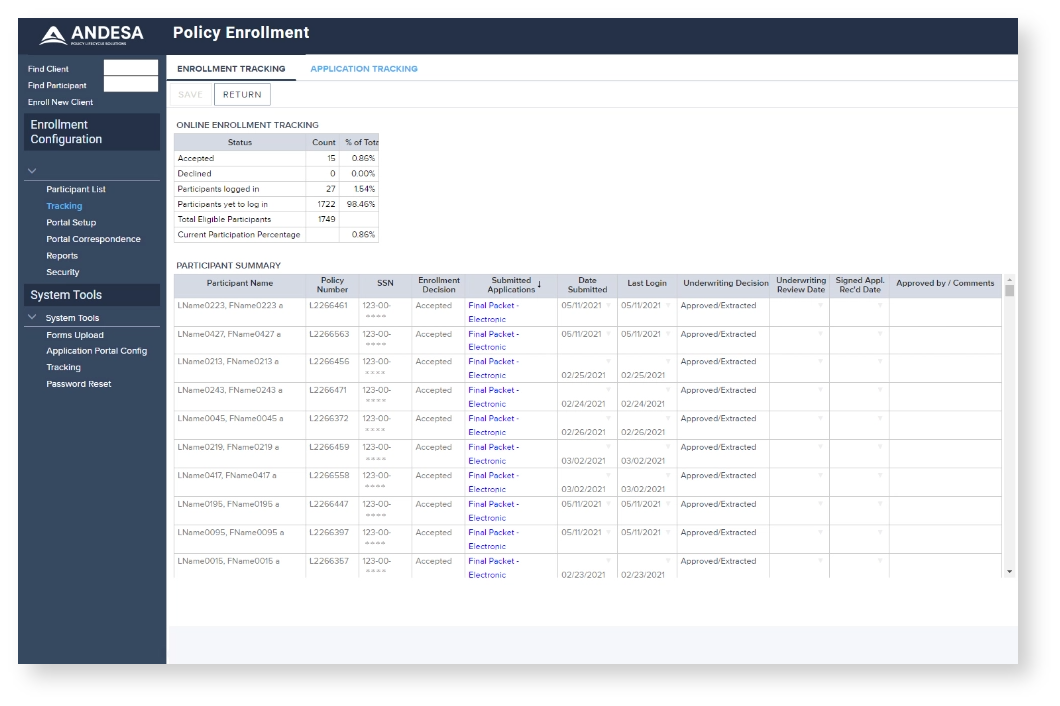

Our portal is an e-application fulfillment solution that increases efficiency, ensures data accuracy, and accelerates life insurance application submissions and group enrollments. Mitigate the need for manual processes, get a head start on tedious processes and requirements, and provide complete, in-good-order electronic new business data submission with e-signature support.

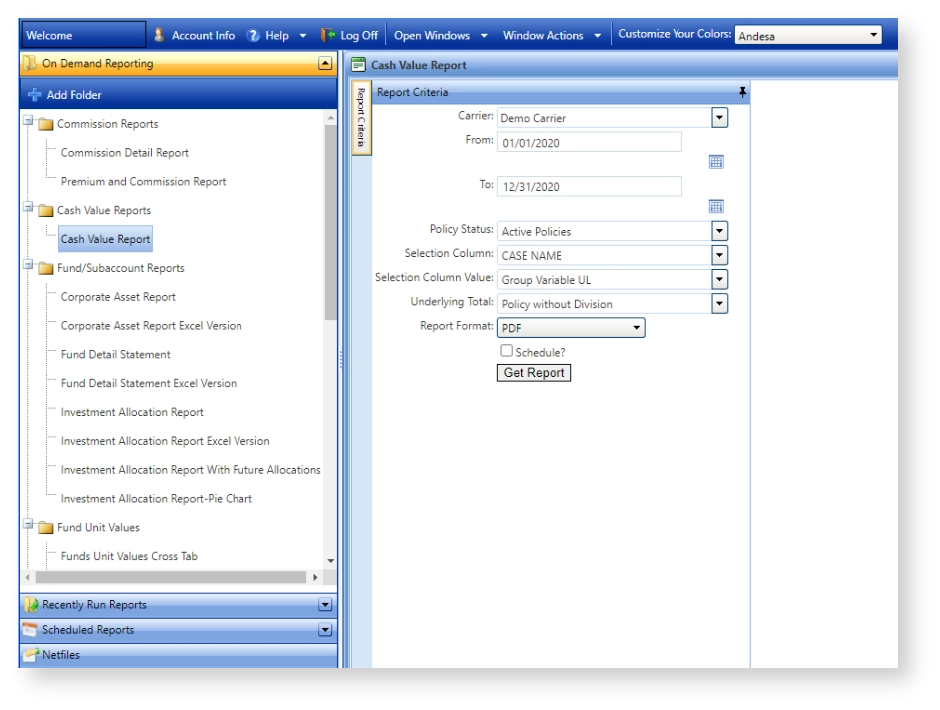

Generate dynamic recurring, scheduled, and custom ad hoc reports at the case, division, or policy level based on flexible predefined parameters or standard system settings. Our centralized, private cloud reporting warehouse allows you to get easy access to reports at the case, division or policy level.

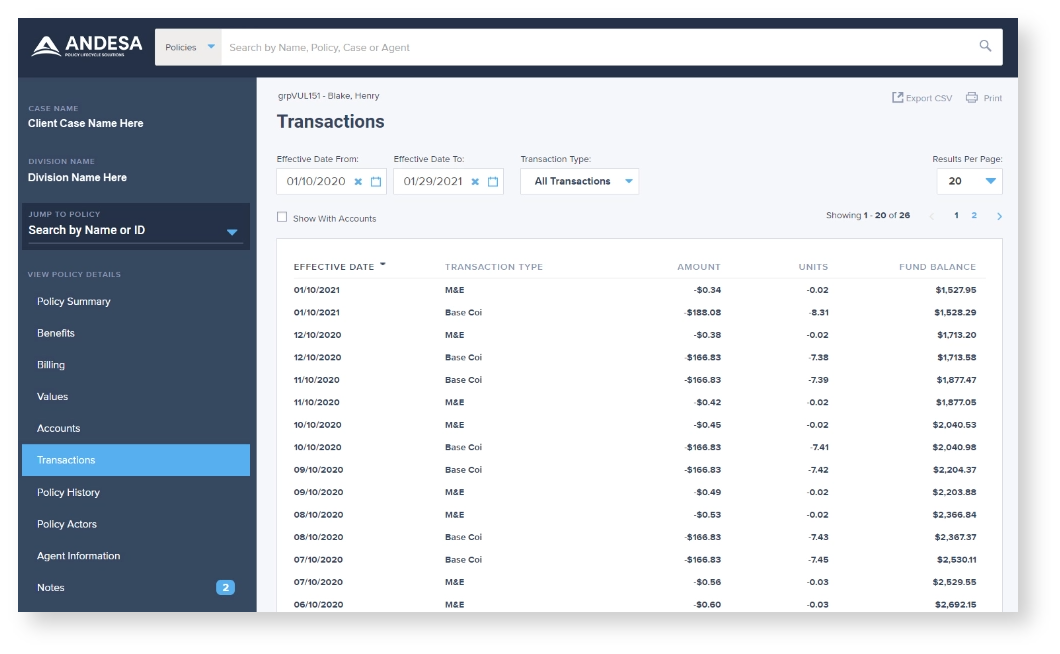

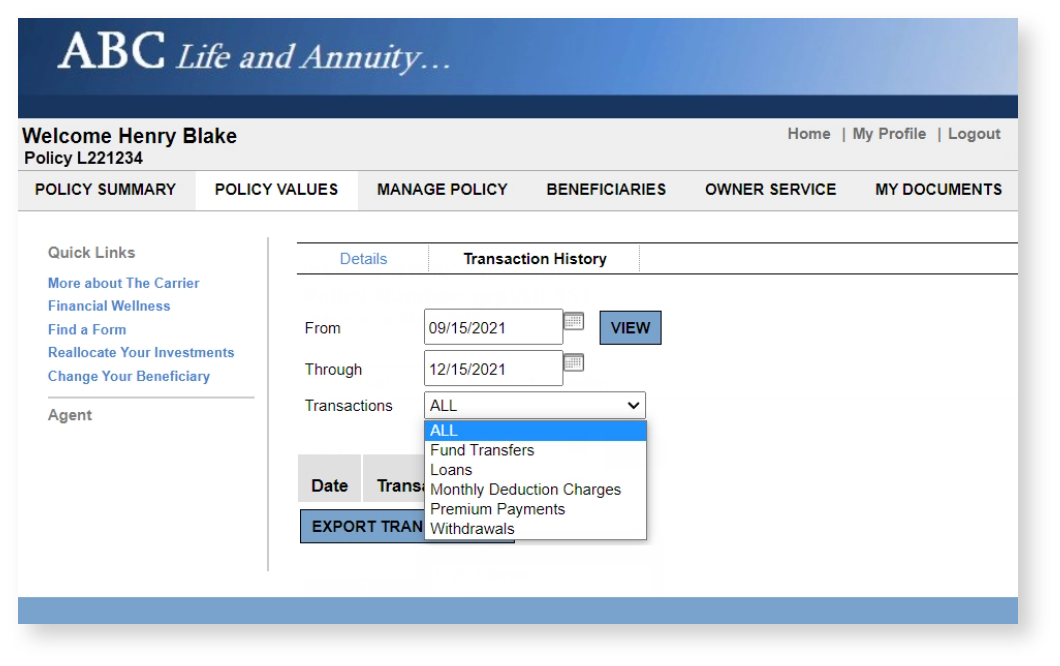

Obtain instant access to granular case, division, and policy information daily through a web-based policy inquiry tool to give customer service representatives, distributors, and home office staff the opportunity to retrieve current policy statuses and view transactions accumulated during the lifetime of specific policies.

Seamlessly manage policy conversion, reporting, validation, and inquiries with Andesa’s Policy Administration solution. An advanced conversion engine allows users to efficiently transfer blocks of policies from legacy systems to Andesa’s cloud-based Policy Administration software based in a secure, centralized private cloud environment. Quickly complete validated, error-free policy conversions through a highly repeatable process that custom-maps data for easy input.

The self-service portal empowers the policyholder to handle routine policy servicing and reduces the need for carriers and call center customer support. Allow policyholders to maintain the life insurance portion of their financial portfolio in a secure, private, and redundant cloud environment that is customizable, accurate, up to date, and easily accessible.